If you have dreams of standing in front of Mr. Wonderful in The Shark Tank there is one metric you should come prepared to speak to: Customer Lifetime Value (aka CLTV, LCV, LTV, Oh M Gee). By definition, it is the net profit you can expect from a given customer’s purchases over the entire life of the customer relationship. There are two main approaches to calculating CLV: complicated and simple. We are covering the simple way.

Why Is Customer Lifetime Value Important?

CLV is a good tool for forecasting future sales and profits, using resources efficiently and controlling costs. Many new business owners assume that all of their customers are equally valuable. But for most companies, your top 20% of customers are contributing the most to your business.

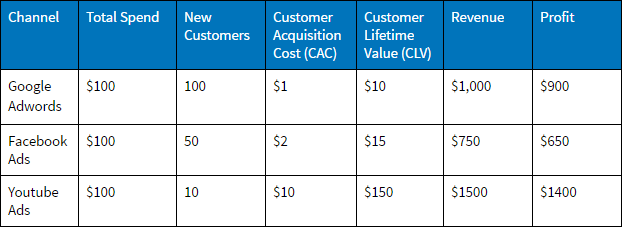

Also, you can’t grow a business on word of mouth and free marketing channels alone. CLV lets you spend to acquire more customers while still making a profit. It also helps you decide which channels are the best to contribute to.

Image Credit: Nicholas Hahn

Get this, only 5% of online businesses even track it.

How To Calculate LTV

If we want to calculate LTV (Customer Lifetime Value) we need some information about your customers.

- Annual revenue per customer (aka ARPC)

- Average number of years that a customer relationship with your business lasts

- Initial cost of customer acquisition

It’s important all this data comes from the same time period, to make it easy, let’s say 2016.

Annual Revenue Per Customer

This equals Total Revenue/Customer Count. So if your business generated 100,00 in sales in 2016, thanks to 1,000 customers. Your annual revenue per customer is $100.

Average # of Years Customers Stick Around

For the purposes of this equation, let’s say our business has been around for 5 years.

Initial Cost of Customer Acquisition

Luckily I reviewed that in detail here. For the sake of this formula, lets say its $10.

Let the LTV Calculating Party Begin

You ready to dance, LTV formula?

LTV = Annual revenue per customer x number of years – cost of customer acquisition

$490 = $100 x 5 – $10

This puts our LTV/CLV/Oh em gee at $490. We know that we will get $490 from this customer over their time shopping with us. So spending even $100 to acquire them seems like smart math, as long as our cost stay flat.